The cost of capital is a foundational concept in corporate finance, influencing investment decisions, company valuation, and financial planning. Whether you’re a finance student, investor, or business leader, understanding how companies assess and manage the cost of capital — particularly through tools like the Weighted Average Cost of Capital (WACC) — is essential.

In this comprehensive guide, we’ll break down the principles, components, calculations, and practical uses of cost of capital and WACC in easy-to-understand terms.

What Is the Cost of Capital?

The cost of capital refers to the minimum rate of return a company must earn on its investments to maintain its market value and satisfy its investors. It serves as a benchmark for evaluating investment opportunities and managing corporate finances effectively.

Why the Cost of Capital Matters

-

Investment Decision-Making: Helps determine whether a project will generate enough returns to cover its cost.

-

Valuation of Firms: Affects discount rates in discounted cash flow (DCF) models.

-

Performance Benchmark: Used to assess management’s efficiency in using capital.

-

Strategic Planning: Guides decisions about financing through debt, equity, or internal cash.

Types of Cost of Capital

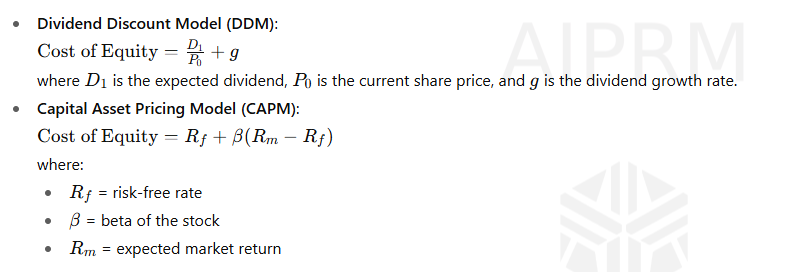

1. Cost of Equity

This is the return expected by shareholders. It’s not a direct expense like interest, but it reflects the opportunity cost of equity investment.

Common formulas:

2. Cost of Debt

This is the effective interest a company pays on its borrowed funds, adjusted for tax savings due to interest deductibility.

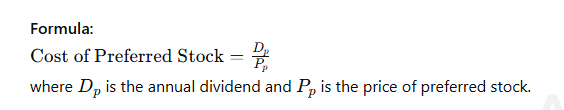

3. Cost of Preferred Stock

Preferred shareholders receive fixed dividends, so the cost of preferred stock is calculated similarly to a perpetuity:

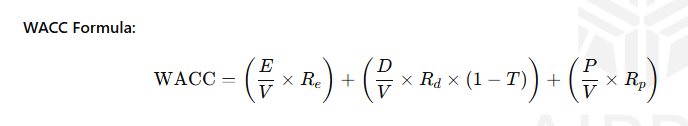

Introducing Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) combines the costs of equity, debt, and preferred stock based on their proportions in a company’s capital structure. It represents the average rate a company pays to finance its assets.

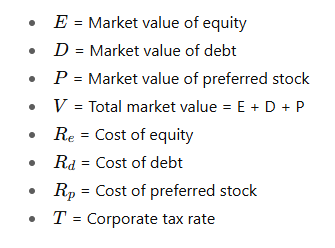

Where:

How to Calculate WACC: A Simple Example

Suppose a company has the following:

-

Equity: $600,000, Cost of equity: 12%

-

Debt: $300,000, Cost of debt: 8%

-

Preferred Stock: $100,000, Cost of preferred: 10%

-

Tax Rate: 30%

Step-by-step WACC:

-

Total capital = $600,000 + $300,000 + $100,000 = $1,000,000

-

Weighted components:

-

Equity = 60%

-

Debt = 30%

-

Preferred = 10%

-

-

After-tax cost of debt = 8% × (1 – 0.30) = 5.6%

-

WACC = (0.60 × 12%) + (0.30 × 5.6%) + (0.10 × 10%)

= 7.2% + 1.68% + 1.0%

= 9.88%

Factors Influencing the Cost of Capital

1. Macroeconomic Conditions

-

Interest rates and inflation directly affect the cost of debt and equity.

2. Company-Specific Risks

-

High business or financial risk increases required return from investors.

3. Capital Structure

-

A balanced mix of debt and equity can reduce WACC due to the tax shield from debt.

4. Market Sentiment

-

Market volatility and investor behavior influence equity valuation and returns.

Decision Making

Capital Budgeting

Companies use WACC as the discount rate in NPV (Net Present Value) and IRR (Internal Rate of Return) models to assess the viability of projects.

-

NPV > 0: Accept project

-

IRR > WACC: Accept project

Business Valuation

Discounted cash flow (DCF) models use the cost of capital to estimate a firm’s intrinsic value. A lower WACC increases valuation, and vice versa.

Mergers & Acquisitions

WACC helps evaluate the cost-effectiveness of acquiring another company and whether the target company will create shareholder value.

WACC vs. Required Rate of Return

While both terms are similar, WACC is an average across all financing sources, whereas the required rate of return (RRR) is more specific to an investment’s risk level.

If a project’s expected return is greater than the RRR or WACC, it is generally deemed worthwhile.

Startups and SMEs

Small and growing businesses often face a higher cost of capital due to:

-

Higher perceived risk

-

Limited access to capital markets

-

Dependence on expensive funding sources (like venture capital)

However, innovative startups with high growth potential may still attract investors even with a higher cost of capital.

How to Reduce

Optimize Capital Structure

-

Finding the right balance of debt and equity can lower overall financing costs.

Improve Credit Rating

-

A better credit rating leads to lower interest rates on debt.

Increase Operational Efficiency

-

Consistent profits reduce perceived risk and attract cheaper capital.

Transparent Corporate Governance

-

Builds investor confidence, potentially lowering the cost of equity.

Cost of Capital in the Real World

Case Study: Apple Inc.

Apple, with a strong balance sheet and high credit rating, enjoys a low cost of debt. Despite having billions in cash, it uses low-interest debt strategically for stock buybacks and dividends — a move that keeps the WACC low while maximizing shareholder returns.

Case Study: Tesla Inc.

Tesla faced a high cost of capital in its early years due to business risk and uncertainty. As profitability and market share increased, Tesla’s WACC declined, giving it more flexibility to invest and expand.

Common Mistakes in Calculating

-

Ignoring Market Values: Use market values, not book values, for weights.

-

Using Historical Returns: Focus on expected future returns.

-

Incorrect Tax Rate: Use the marginal tax rate, not average.

-

Not Updating Inputs: WACC should be recalculated as capital structure and market conditions change.

FAQs

Is a lower cost of capital always better?

Not necessarily. Too much debt can reduce WACC but increase financial risk.

Can WACC be negative?

No. While individual components (like debt after taxes) might approach zero, overall WACC stays positive.

Is cost of capital the same for all companies?

No. It varies by industry, financial health, capital structure, and perceived risk.

How often should WACC be updated?

Whenever there’s a material change in capital structure, risk profile, or market conditions.

You can also read : Working Capital Management: Techniques and Examples

Final Thoughts

Understanding the cost of capital — and how to calculate, interpret, and manage it — is critical to sound financial decision-making. Whether you’re planning investments, evaluating projects, or valuing businesses, WACC serves as a vital tool in your financial toolkit.

Mastering this concept empowers you to make smarter, more strategic decisions that align with the long-term value creation goals of any organization.