In the intricate world of corporate finance, understanding capital structure is essential for investors, analysts, and business leaders alike. It not only determines how a company funds its growth and operations but also affects its risk profile, cost of capital, and overall valuation. In this in-depth article, we explore what capital structure is, why it matters, the different types of financing, theories behind it, and how companies make optimal financing decisions.

What Is Capital Structure?

Capital structure refers to the mix of debt and equity that a company uses to finance its operations and growth. In simple terms, it’s how a company pays for everything it does—whether by borrowing money (debt), selling ownership shares (equity), or a combination of both.

Components

There are two main components:

1. Equity Financing

Equity financing involves raising capital by selling shares of the company. This can be in the form of:

-

Common Stock: Gives shareholders ownership and voting rights.

-

Preferred Stock: Has a fixed dividend and has preference over common stock in liquidation but usually lacks voting rights.

-

Retained Earnings: Profits reinvested back into the business instead of being paid as dividends.

Pros of Equity Financing:

-

No obligation to repay.

-

Lower financial risk.

-

Helps maintain cash flow.

Cons of Equity Financing:

-

Dilutes ownership.

-

May reduce control over decisions.

-

Dividends are not tax-deductible.

2. Debt Financing

Debt financing involves borrowing funds that must be repaid over time with interest. Common forms include:

-

Bank Loans

-

Corporate Bonds

-

Convertible Debt

-

Lines of Credit

Pros of Debt Financing:

-

Interest is tax-deductible.

-

Does not dilute ownership.

-

Encourages disciplined spending.

Cons of Debt Financing:

-

Fixed interest obligations.

-

Increases financial risk.

-

Can lead to bankruptcy in extreme cases.

Why Capital Structure Matters

Capital structure decisions affect a company’s:

-

Financial risk: The more debt, the higher the fixed obligations.

-

Cost of capital: The right mix minimizes the weighted average cost of capital (WACC).

-

Stock valuation: A sound capital structure enhances investor confidence.

-

Flexibility and control: Balance between control (equity) and obligations (debt).

An Overview

Over the years, several academic theories have attempted to explain how firms choose their capital structures.

1. Modigliani-Miller Theorem (MM Theory)

Proposed in 1958 by Franco Modigliani and Merton Miller, this theory suggests that in a perfect market, the capital structure is irrelevant to the value of the firm.

-

With no taxes: Value remains unchanged regardless of debt-equity mix.

-

With taxes: Debt financing offers a tax shield, increasing firm value.

Criticism: Assumes no bankruptcy costs, perfect markets, and rational investors—unrealistic in practice.

2. Trade-Off Theory

This theory recognizes the tax advantage of debt but balances it against the costs of financial distress.

-

Firms should borrow up to the point where the marginal tax benefit of debt = marginal cost of financial distress.

3. Pecking Order Theory

Developed by Myers and Majluf, it suggests that companies prefer internal financing (retained earnings), then debt, and finally equity.

Key Takeaway: Capital structure is shaped not by an optimal ratio but by financing choices in response to information asymmetry and transaction costs.

4. Market Timing Theory

Firms try to “time the market” by issuing equity when stock prices are high and repurchasing shares or issuing debt when prices are low.

Factors Influencing Decisions

Many real-world factors influence how companies decide between debt and equity:

1. Business Risk

Higher business risk leads firms to use less debt. Firms with stable and predictable earnings can handle more debt.

2. Tax Considerations

Since interest payments are tax-deductible, companies in high tax brackets may prefer debt.

3. Asset Structure

Firms with tangible assets (like real estate or machinery) can use more debt, as these assets can be used as collateral.

4. Growth Opportunities

High-growth firms often rely on equity, especially when future earnings are uncertain and debt increases risk.

5. Market Conditions

In bullish markets, equity may be more attractive. In downturns, firms may avoid diluting shares and opt for debt.

6. Management Preferences

Risk-averse management may prefer low-debt structures, even if it’s not financially optimal.

7. Industry Norms

Capital structure varies across industries. For instance:

-

Utility companies: High debt levels.

-

Tech startups: High equity reliance.

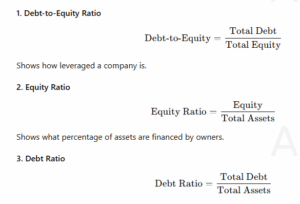

Capital Structure Ratios

To assess a company’s capital structure, analysts use several key ratios:

Indicates a firm’s ability to pay interest from its earnings.

Real-World Examples

Apple Inc.

Apple has historically preferred low debt, relying on massive cash reserves. However, in recent years, it issued bonds to take advantage of low-interest rates—even while sitting on billions in cash—demonstrating market timing and tax efficiency.

Tesla Inc.

Tesla initially relied heavily on equity due to uncertain cash flows and risk perception. As profitability improved, Tesla started reducing equity dilution and began to repay debts.

General Electric (GE)

GE was once heavily leveraged. After the 2008 financial crisis, it restructured its capital structure by reducing debt and divesting risky assets to improve financial stability.

Optimal Capital Structure: Is There One?

The optimal capital structure is the mix of debt and equity that minimizes a company’s cost of capital and maximizes value.

However, there’s no universal answer. It depends on:

-

Company-specific risk

-

Industry dynamics

-

Market conditions

-

Tax considerations

-

Regulatory environment

Capital Structure Planning Process

Here’s how companies typically approach capital structure planning:

1. Assess Current Financial Position

Analyze cash flows, profitability, debt levels, and market value.

2. Define Strategic Goals

Is the goal to grow? Reduce risk? Improve valuation?

3. Evaluate Capital Needs

Determine funding needs for operations, expansion, or acquisitions.

4. Model Scenarios

Test different combinations of debt and equity under various conditions.

5. Review Market Conditions

Assess interest rates, stock market trends, investor sentiment.

6. Choose Financing Instruments

Decide between short-term vs long-term debt, public vs private equity, hybrid instruments, etc.

Hybrid Financing Instruments

Companies may also use hybrid instruments that combine features of both debt and equity:

-

Convertible Bonds: Debt that can convert into equity.

-

Mezzanine Financing: High-yield debt with equity options.

-

Preferred Shares: Equity with bond-like dividend features.

These instruments help customize capital structure according to a firm’s needs and investor expectations.

Impact of Capital Structure on Firm Value

A well-structured capital mix can:

-

Reduce cost of capital.

-

Improve credit ratings.

-

Increase return on equity.

-

Boost investor confidence.

On the flip side, poor capital structure decisions can:

-

Trigger downgrades.

-

Lead to insolvency.

-

Dilute control and value.

-

Increase vulnerability during downturns.

Capital Structure in Emerging Markets

In emerging economies, companies often:

-

Rely more on bank loans due to underdeveloped capital markets.

-

Face higher interest rates and credit risk.

-

Experience regulatory constraints.

This makes capital structure decisions even more complex and sensitive to macroeconomic shifts.

Capital Structure Trends in 2025

With interest rates stabilizing after global inflation spikes, many companies in 2025 are:

-

Reducing excessive debt taken during 2020–2022 low-rate periods.

-

Raising equity capital to rebalance leverage.

-

Using ESG-linked bonds as part of sustainable capital strategies.

-

Re-evaluating global supply chain risks in financing decisions.

Crafting a Sound Capital Structure

Capital structure is more than a finance formula—it’s a strategic pillar that shapes a company’s destiny. Whether you’re managing a Fortune 500 firm or a high-growth startup, the right mix of debt and equity:

-

Enhances value,

-

Reduces financial distress,

-

And strengthens resilience in a volatile world.

Ultimately, the best capital structure aligns with the company’s goals, risk tolerance, and market realities.

You can also read : What Is Corporate Finance? A Beginner’s Guide

Key Takeaways

-

Capital structure is the combination of debt and equity used to finance operations.

-

Each component has benefits and trade-offs that affect risk, cost, and control.

-

Theories like Modigliani-Miller, trade-off, and pecking order offer frameworks for decision-making.

-

There’s no one-size-fits-all solution—strategy must align with the company’s financial and strategic goals.